VIENNA, AUSTRIA / ACCESS Newswire / May 15, 2025 / In Gold We Trust report was presented at an international press conference broadcast live on the Internet. The authors of the report are Ronald-Peter Stöferle and Mark J. Valek, fund managers at Liechtenstein-based asset manager Incrementum AG.

The 450-page In Gold We Trust report is renowned worldwide and was honored by the Wall Street Journal as the “gold standard of all gold studies.” Last year’s edition was downloaded and shared more than 2 million times. This makes the In Gold We Trust report the most widely read gold study in the world. In addition to the German and English versions, the compact version of the report has been published in Chinese and Spanish for several years and, for the first time this year, in Japanese.

The In Gold We Trust report2025 covers the following topics, among others:

-

Status quo of gold: price development over the last 12 months, key influencing factors and trends on the gold market

-

Leitmotif: The Big Long or: The second half of the golden decade

-

Update of the Incrementum Gold Model: The price target of USD 4,800 by 2030 remains unchanged; in an inflationary scenario, a price of up to USD 8,900 is conceivable.

-

The dynamics of the New Gold Playbook presented in 2024 are solidifying. The influence of emerging Asian markets on the gold price is becoming increasingly significant.

-

Demand from central banks remains significantly higher, and ETF demand from Western investors is now also increasing, albeit belatedly.

-

The geo-economic realignment of the US is having an increasingly supportive effect on the gold price.

-

-

Silver: Record gold/silver ratio meets structural supply deficit – significant catch-up potential relative to gold.

-

Mining stocks – fundamental and technical situation

The In Gold We Trust report 2025 also includes a debate with star analysts Luke Gromen and Louis-Vincent Gave, titled “From Trade Restructuring To Monetary Reset?”. They discuss, among other things, the impact of Donald Trump’s tariff policy on the international monetary order and what a Mar-a-Lago accord could entail.

The key messages of the In Gold We Trust report 2025

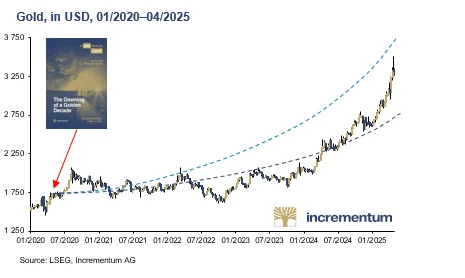

Gold achieved significant gains in the first half of the Golden Decade

In the In Gold We Trust report 2020, the authors announced the beginning of a Golden Decade. Since then, gold has recorded significant gains – around 100% in USD and almost 90% in EUR. The year 2024 marked the most substantial annual gains to date, with an increase of +27.2% in USD and +35.6% in EUR. The upward trend also continued in 2025: Since the beginning of the year, gold has gained around 26% in USD and around 13% in EUR.

The New Gold Playbook presented in 2024 remains intact

The economic and geopolitical factors that support the gold price, as presented in our 2024 New Gold Playbook, have become more entrenched over the past 12 months. The sovereign debt situation remains tense, and the geopolitical realignment of the US brings further uncertainty and could ultimately lead to a new international currency architecture.

Central bank demand hits another record high in 2024; ETF demand from the West rises

In 2024, central banks increased their gold reserves by a new record of 1,086 tons, marking the third consecutive year in which they had done so by more than 1,000 tons. Asia continues to dominate central bank demand, while Poland was the European country that bought the most gold. Western investors are participating in the gold price rally, albeit belatedly. After investors from North America, European investors are now also net buyers of gold again.

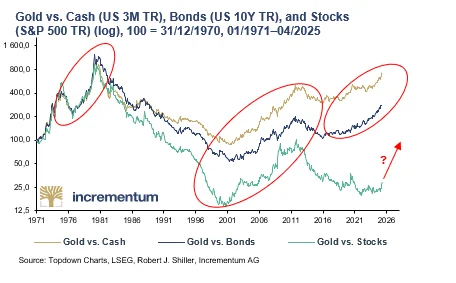

The gold price has also formed technical breakouts relative to other assets

One aspect deserves particular attention: Gold has now also recorded technical breakouts on a relative level. The incipient relative strength against equities suggests the beginning of a new trend phase.

Performance gold and digital gold with plenty of room for improvement despite gains

Silver and mining stocks, subsumed under the term performance gold, have recorded significant double-digit gains since the In Gold We Trust report2024. The absolute and relative price levels still show tremendous potential. Bitcoin as digital gold also had a successful year in 2024. The law to establish a strategic Bitcoin reserve in the US is a milestone in the adoption of Bitcoin by state actors.

Inflation volatility remains elevated

The inflation rate, especially core inflation, remains at an elevated level. If the new tariffs stay in place, significant price-driving effects are expected, particularly in the US. Although falling energy prices tend to have a dampening impact on inflation in the short term, the risk of a depreciation of the US dollar or a renewed wave of inflation remains a realistic concern.

Long-term gold price target (2030) of USD 4,800 confirmed

The authors are sticking to their gold price forecast of 4,800 by the end of 2030, as presented in 2020, with the calculated interim target of USD 2,942 for the end of 2025 having already been significantly exceeded. Achieving this price target requires an annualized return of around 8%. Given the recent momentum on the gold market, the inflationary scenario, with a decade price target of around USD 8,900, also seems realistic. The arithmetical interim target for this scenario is USD 4,080 at the end of 2025.

Mid-term review of the Golden Decade

“Since the ‘Golden Decade’ was proclaimed in 2020, the gold price has undergone a remarkable development and is currently moving between the two mathematical paths of our decade forecast at the time. Since the publication of the 2024 report alone, the increase in US dollars amounts to over 35% – and gold has thus clearly outperformed most stock markets,” says Ronald-Peter Stöferle.

Gold relative technical breakouts against other assets

According to the In Gold We Trust report, it is not only the numerous absolute price records that deserve attention: Anyone looking “under the hood” of the market will recognize that gold is also recording technical breakouts on a relative basis. In particular, the relative strength now emerging against equities points to the start of a new trend phase.

Central bank demand for gold remains an essential driver of the bull market

A central thesis of the authors is that the gold market now works differently. While US real yields and thus the opportunity costs of gold were of decisive importance in determining the gold price for a long time, it is now the central banks’ demand for gold that is relatively price-insensitive. A key cornerstone of The Big Long is the persistently strong physical demand from central banks. They have been net buyers on the gold market since 2009. This trend has accelerated significantly since the confiscation of Russian currency reserves at the end of February 2022. For three years in a row, central banks increased their gold reserves by more than 1,000 tons each time, achieving a special kind of hat trick.

The central banks’ appetite for gold still does not appear to be abating, as confirmed by purchases of 333 t in Q4/2024 alone and 244 t in Q1/2025.

As of February 2025, the global gold reserves of central banks totaled 36,252 t. The relative share of gold in total reserves has more than doubled since 2016, reaching a 27-year high of 18.2%. Gold is becoming an increasingly important asset on the central bank balance sheet – in other words, gold is being gradually remonetized by central banks.

“The central banks’ purchases are impressive, if not surprising. Inflation and geopolitical uncertainties make neutral, non-inflationary and counterparty-risk-free gold particularly attractive, while fiat currencies, but especially the world’s reserve currency, the US dollar, are losing appeal,” comments Mark Valek on the gold rush in the East. Stöferle adds: “The ever-increasing importance of gold markets outside the West has prompted us to shed light on developments in Saudi Arabia in this report.”

Performance gold, commodities and Bitcoin with gains – and plenty of room for improvement

The authors remain confident not only for gold – although a correction cannot be ruled out after the rapid rise in prices in recent quarters. They now see increasing opportunities in those assets they summarized in the In Gold We Trust report 2024,”The new gold playbook“, under the term performance gold (silver and mining stocks) and commodities, which have also come into the spotlight in the slipstream of gold, albeit still cautiously.

The following table illustrates the potential of silver, mining stocks, and commodities in the context of historical gold bull markets. A comparison of performance to date in the current decade with that of the 1970s and 2000s reveals considerable catch-up potential for silver and mining stocks, in particular.

Performance of Gold, Silver, Mining Stocks*, and Commodities**, in Bull Market Decades, in USD, 12/1969-04/2025

|

1970s |

2000s |

2020s |

|||||||

|

1st Half |

2nd Half |

Total*** |

1st Half |

2nd Half |

Total*** |

1st Half |

2nd Half |

Total*** |

|

|

Gold |

452% |

162% |

2,259% |

52% |

150% |

555% |

73% |

25% |

118% |

|

Silver |

167% |

525% |

2,663% |

26% |

111% |

788% |

65% |

11% |

84% |

|

Mining Stocks |

363% |

17% |

1,292% |

191% |

89% |

749% |

17% |

41% |

65% |

|

Commodities |

379% |

44% |

754% |

93% |

-18% |

103% |

38% |

0% |

38% |

Source: LSEG, Incrementum AG

*BGMI 12/1969-05/1996, HUI 05/1996-. **GSCI Index TR. ***Decade start to high.

The authors’ thesis is that gold will once again lead the way, with silver, mining stocks, and commodities following in its wake. The dynamic resembles a relay race: Gold takes the starting position, sets the pace, and pulls the field apart. Silver, mining stocks, and commodities then take the baton.

Silver

The gold/silver ratio stood at 100.9 at the end of April and is therefore in the 100th percentile. The long-term median since 1970 is 62.8, which further underlines the striking current divergence. In the past, similarly extreme ratios have been followed by outperformance of silver.

Fundamentally, everything seems to be in place for gold’s little brother: Silver recorded a supply deficit for the fourth time in a row in 2024. Demand exceeded supply by 148.9 million ounces (Moz). Between 2021 and 2024, the cumulative deficit totaled 678 Moz, equivalent to approximately ten months of global mine production. A fifth supply deficit of 117.6 Moz is forecast for 2025.

This shortage is primarily caused by the ongoing boom in photovoltaic applications. This key sector of the energy transition, which is dominated by China, is now the second largest demand driver for silver after jewelry and was responsible for a demand of 197.6 Moz in 2024.

Investment demand could become the primary driver of silver’s price in 2025. The explosive growth of Indian ETP holdings – with 40% of private investment inflows and 70 Moz net investment – points to a change in market dynamics.

Mining stocks

While the gold price has made countless new all-time highs in recent months, the HUI is trading just under 40% below its all-time high of 635 in September 2011. Despite a 25.8% increase in the gold price in calendar year 2024, the GDX and GDXJ only gained 10.1% and 14.9%, respectively. In the first four months of 2025, the performance was significantly more positive, at 42.5% (HUI), 44.5% (GDX), and 43.6% (GDXJ), but the mines were still unable to emancipate themselves from the gold price fully.

Despite persistent prejudices, the gold mining sector has undergone a fundamental transformation in recent years. Improved capital discipline, solid balance sheets, and significantly higher margins speak for a new foundation. Companies in the GDM index currently exhibit better debt ratios and higher profitability than those in the S&P 500. At the same time, gold stocks are considered to be historically cheaply valued, with a valuation discount last seen at the beginning of the gold bull market around 2000.

“When investing in the mining sector, a passive buy-and-hold strategy is not advisable due to the high volatility. In our view, an active mining stock strategy using our new, proprietary Incrementum Active Aurum signal is superior to a passive strategy from both a performance and risk perspective,” says fund manager Stöferle.

Commodities

The commodity cycle is currently experiencing an exhausting pause. The recent discrepancy between the price of gold and oil is particularly striking. Most recently, the uncertainty surrounding the US’s new tariff policy has had a particularly negative impact on commodity prices. Historically, phases of decoupling between gold and oil prices are pretty standard; however, commodity supercycles are largely synchronized, even if the respective turning points are sometimes delayed. This can be illustrated by comparing the relative performance of gold and oil against the S&P 500.

According to the authors, the commodities market will reflect the new geopolitical realities in the medium term: While the US is reducing its global leadership role, Europe, China, and the rest of the world are expanding their defense and energy infrastructure, driving demand for strategic commodities.

Bitcoin

With the introduction of a strategic Bitcoin reserve (SBR) by the US, it is evident that Bitcoin is being increasingly taken seriously as a geopolitical asset. “Since the executive order to introduce a strategic Bitcoin reserve, nation states have also officially entered the race for digital gold,” explains Mark Valek, fund manager of two fund strategies with Bitcoin exposure at Incrementum. Given growing geopolitical tensions, the advantages of a decentralized store of value that can be used across borders are becoming increasingly apparent. “Bitcoin is not just an object of speculation, but could establish itself as an alternative, monetary store of value in the context of the global reorganization – and even as an instrument for settling international trade flows in the medium term if volatility falls,” Valek continues.

Bitcoin’s market capitalization currently accounts for approximately 8% of gold’s market capitalization. In a long-term bullish scenario, the authors of the In Gold We Trust report believe an increase to 50% is possible. “Based on our conservative gold price target of USD 4,800, this would correspond to a Bitcoin price of around USD 900,000 by the end of the decade,” emphasizes Valek.

The 10 most important reasons for The Big Long

The following reasons suggest that gold will continue to shine in the second half of the decade, despite the numerous all-time highs reached in the past twelve months.

-

The gold price is in a secular bull market

The gold price has risen sharply since its low; but according to historical cycle analysis, we are only in the middle phase of the uptrend. Corrections are possible at any time, and the “drop height” has increased significantly in view of the rapid price rise, especially in absolute terms.

-

Fodder for the continuation of the gold bull market

More-than-priced-in interest rate cuts by the Federal Reserve, a relaunch of QE, the incipient economic downturn, and a possible revaluation of gold reserves are supporting the rally. Additionally, the explicit political desire to weaken the US dollar is eroding confidence in the greenback.

-

Central banks as constant buyers of gold

The significant increase in demand for gold from central banks since 2022 is consolidating at a high level and forming a stable pillar of demand. These purchases are relatively price-independent and underpin gold’s role as a strategic, politically neutral reserve asset.

-

From contrarian asset to mainstream investment

Gold is changing from a niche investment to a permanent portfolio component. After four years of outflows, physically backed gold ETFs have recorded consolidated net inflows of USD 21.1bn (226 t) since the beginning of the year. This was the second-highest figure in US dollars after Q2/2020.

-

Silver, mining stocks, and commodities follow suit

Silver, mining stocks, and commodities typically follow the gold rally with a time lag and now show disproportionately high catch-up potential. After years of underperformance, our analysis suggests a relative undervaluation and outperformance compared to gold.

-

Stagflation risk growing, possibly even recession on the horizon

The US economy is cooling down, and the unfolding trade war is further weakening the economy, while inflation remains stubbornly above 2%. This makes a stagflationary scenario more realistic, an environment that has historically proved supportive for the gold price.

-

From DragonBear to EagleBear – geopolitical upheavals

Trump is questioning old alliances in the implementation of his America First policy, while the BRICS+ states are testing new currency and trade routes. The EU is caught between these fronts and is struggling with an increasing loss of importance.

-

Physical demand: Let’s get physical

The Fort Knox audit, rising repatriations, and high physical inflows in Asia reflect mistrust in the gold market. The most recent spike in lease rates signaled a very tense supply-demand imbalance for physical gold.

-

New gold playbook under Trump and Bessent

Gold is increasingly becoming the focus of the US financial architecture. Whether through the possible revaluation of US gold reserves, gold-backed bonds, or stricter sanctions, gold will continue to gain in importance on both geopolitical and monetary policy levels.

-

Incrementum shadow gold price – gold remains cheap

Despite numerous new all-time highs, gold remains undervalued in relation to monetary aggregates, government debt, and the currency reserves of central banks. The idea of a remonetization of gold is increasingly gaining ground.

Outlook

This year’s edition of the In Gold We Trust report also addresses the question of whether gold is already (too) expensive. “One thing is certain: gold is no longer a contrarian investment as it was in 2020; the bull market has entered a new phase. However, monetary comparisons such as the shadow gold price indicate that gold could still have (a lot of) room to rise,” says Stöferle, who published his first gold study (then still for Erste Group) when the price was USD 670 per ounce.

Some monetary comparisons indicate that gold still has potential, considering its historical all-time highs. During the gold bull market of the 2000s, the gold coverage of the monetary base tripled, increasing from 10.8% to 29.7%. A comparable coverage ratio today would result from a gold price of over USD 6,000. In the 1930s and 1940s, as well as in 1980, gold coverage even reached values of over 100%. The record value of 131% (1980) would currently correspond to a gold price of around USD 30,000. Currently, the implicit gold coverage ratio of the US monetary base is 14.5%.

A comparison with the stock market also lends confidence to the analysts. Currently, the market capitalization of global gold holdings is around 40% of the US equity market capitalization, which is slightly above the long-term median of 37.9%. By way of comparison: During the war years and the inflation era of the 1970s, this figure reached peaks of up to 160%. Even at the peak of the last secular gold bull market in August 2011, the value was significantly higher at 69.2%. “This shows that the current gold bull market has already picked up speed, but we are still a long way from the mania phases of past peaks,” says Gregor Hochreiter, editor-in-chief of the In Gold We Trust report. He continues: “We expect the market capitalization of gold to have increased further relative to equities by the end of the Golden Decade.”

This year, the fund managers also provided their long-term gold price forecasts. The short-term market situation is tense; a correction to ~USD 2,800 does not seem unrealistic. A temporary sideways market would also be conceivable as part of a price consolidation and would ultimately be healthy for the bull market.

This would in no way jeopardize the medium to long-term Big Long case for gold: “We confirm our long-term gold price target, which we calculated in the In Gold We Trust report2020 based on our proprietary gold price model. This amounts to USD 4,800 in the base scenario by the end of the decade. This corresponds to an annualized return of just over 8% p.a. until December 2030. By comparison, the annualized return in the 2000s was just under 14.5%. In the comparatively low-yielding 2010s for gold, the value was 3.3%,” explains Valek, adding: “In the inflationary scenario, around USD 8,900 would be realistic by the end of 2030. The interim target for the end of 2025, based on our gold price model in this scenario, is a gold price of USD 4,080. The base scenario’s interim target of USD 2,942 has already been reached.”

“The Big Long,” concludes Stoeferle, “is not least a positioning with an asymmetrical payout profile if gold plays a monetary role again in the future.”

About the In Gold We Trust report

This annual gold study has been written by Ronald-Peter Stöferle for 18 years and, together with Mark Valek, for the past 11 years. It provides a holistic assessment of the gold sector, including the most important influencing factors, such as the development of real interest rates, opportunity costs, debt, and monetary policy. The study is regarded as an international standard work for gold, silver, and mining stocks. In addition to German and English versions, the short version of the In Gold We Trust report will be published in Spanish for the third time this year. For the first time, the In Gold We Trust report will be available in Japanese, while the Chinese version will be published for the seventh time this fall.

The publishing rights for the In Gold We Trust report were transferred to Sound Money Capital AG in November 2023. The In Gold We Trust report will continue to be co-branded with the Incrementum brand as usual.

The following internationally renowned companies have been won as Premium Partners for the In Gold We Trust report 2025: Agnico Eagle Mines, Asante Gold, Barrick, Caledonia Mining, Cerro de Pasco Resources, Dolly Varden Silver, Elementum, EMX Royalty, Endeavour Mining, Endeavour Silver, First Majestic Silver, First Mining Gold, Fortuna Mining, Harmony Gold, Hecla Mining, McEwen Mining, Minera Alamos, Münze Österreich, Newmont, North Peak Resources, Pan America Silver, Royal Gold, Silver Bullion, Solit Management, Sprott Asset Management, Tudor Gold, U.S. GOLD and VON GREYERZ.

The In Gold We Trust report 2025 will be published in the following issues:

Compact version – Japanese (published for the first time this year)

Compact version – Chinese (to be published for the seventh time in fall 2025)

Starting this year, a print version of the In Gold We Trust report can be purchased via Amazon:

Video of the press conference – English

Video of the press conference – German

All previous issues of the In Gold We Trust report can be found in our archive.

The authors

Ronald-Peter Stöferle is Managing Partner & Fund Manager of Incrementum AG.

Previously, he was part of the research team at Erste Group in Vienna for seven years. As early as 2007, he began publishing his annual In Gold We Trust report, which has gained international renown over the years.

Together with Rahim Taghizadegan and Mark Valek, he published the bestseller Austrian School for Investors in 2014. In 2019, he co-authored The Zero Interest Trap. He is a member of the boards of Tudor Gold and Goldstorm Metals and has been an advisor to VON GREYERZ AGsince 2020 and to Monetary Metals since 2024.

Mark Valek is Partner & Fund Manager at Incrementum AG.

Prior to that, he worked at Raiffeisen Capital Management for over ten years, most recently serving as a fund manager in the Multi-Asset Strategies department. In this position, he was responsible for inflation hedging strategies and alternative investments and managed portfolios with a volume of several hundred million euros.

Together with Rahim Taghizadegan and Ronald-Peter Stöferle, in 2014 he published the book Austrian School for Investors. He has been active as an entrepreneur on several occasions and was co-founder of philoro Edelmetalle GmbH. Since 2024 Mark has held the position of an advisor to Monetary Metals.

Incrementum AG

Incrementum AG is an independent investment and asset management company based in the Principality of Liechtenstein. The company was founded in 2013. Independence, reliability, and autonomy are the cornerstones of the company’s philosophy. The company is wholly owned by the five partners.

Publisher

Sound Money Capital AG

Industriering 21

FL-9491 Ruggell

Principality of Liechtenstein

E-mail:office@ingoldwetrust.li

Webpage: www.ingoldwetrust.report

Press information (photos, press release): www.ingoldwetrust.report/press

Disclaimer:

This publication is for information purposes only and does not constitute investment advice, investment analysis, or an invitation to buy or sell financial instruments. In particular, this document is not intended to replace individual investment advice or other professional guidance. The information contained in this publication is based on the state of knowledge at the time of preparation and may be changed at any time without further notice.

The publishing rights for the In Gold We Trust Report were transferred to Sound Money Capital AG in November 2023. Furthermore, the report continues to be co-branded with the Incrementum brand, as it has been in the past.

The authors have taken the greatest possible care in selecting the sources of information used and (like Sound Money Capital AG and Incrementum AG) accept no liability for the accuracy, completeness or timeliness of the information or sources of information provided or for any resulting liability or damages of any kind (including consequential or indirect damages, loss of profit or the occurrence of forecasts made).

All publications of Sound Money Capital AG and Incrementum AG are, in principle, marketing communications or other information and not investment recommendations within the meaning of the Market Abuse Regulation. Neither company publishes investment recommendations.

Sound Money Capital AG is wholly and exclusively responsible for the content of this In Gold We Trust Report.

Copyright: 2025 Sound Money Capital AG. All rights reserved.

SOURCE: In Gold in Trust

Related Documents:

View the original press release on ACCESS Newswire